Asset Allocation Determines Types of Investment

Asset allocation helps you decide what types of investment to make. David Larrabee, CFA, nicely summarizes the current state of studies about asset allocation.“The studies collectively demonstrate the importance of (1) being in the market, and (2) doing a strategic asset allocation.”As a result of these studies, creative minds developed asset allocation calculators.These asset allocation calculators suggest a mix of investments in your portfolio based on certain assumptions. These calculators consider

- age

- current assets

- projected savings

- investment risk profile

- historical investment performance

- taxes

- projected economic growth

Asset allocation calculators often use historical stock and bond returns to determine their recommendations. However, past stock and bond performance does not mean that future investment returns will be the same.

Asset allocation calculators often use historical stock and bond returns to determine their recommendations. However, past stock and bond performance does not mean that future investment returns will be the same.Introduction to Asset Allocation Calculators

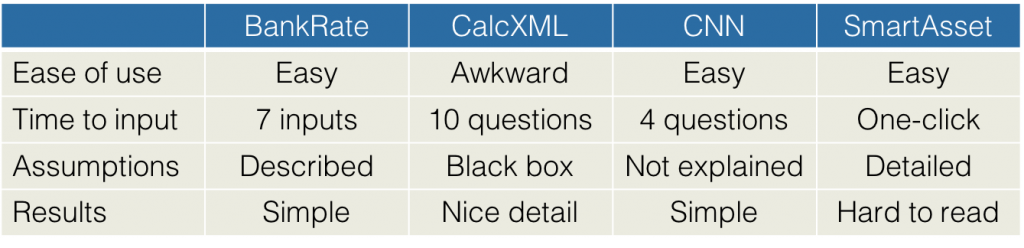

In this introduction to asset allocation calculators, we review four asset allocation calculators from four publishers.- Bankrate

- CalcXML

- CNN

- SmartAsset

Pros and Cons of the Asset Allocation Calculators

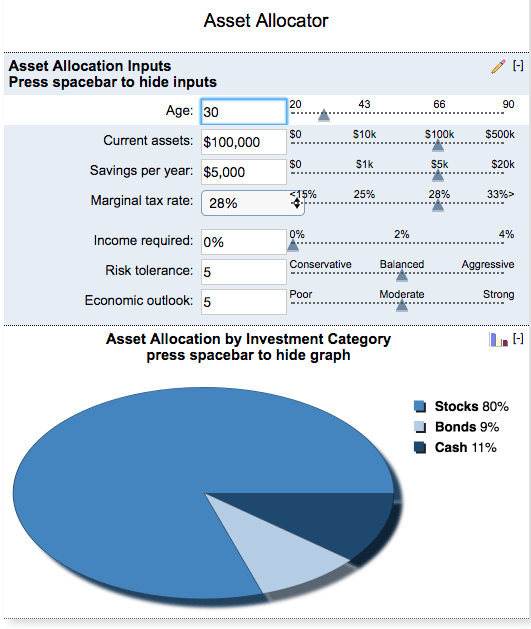

1. Bankrate

Pros

- Data entry is easy to do

- The input fields are neatly displayed above the recommended asset allocation pie chart.

- Users can easily adjust their assumptions using the adjacent sliders

- The Income Required input slowed us down a bit. Nevertheless, investors should consider if some of their portfolio income will be used for current spending. This use of income generally becomes an important factor as people retire

Cons

- The graphical interface is a bit bland. We would like to see more artistic flair

- Before entering your data, you must read the definition of “Income Required”

2. CNN

2. CNN

Pros

- This calculator gives the fastest results

- It works with four simple inputs

- Colorful graphic output

Cons

- The calculator only has four simple inputs. Inevitably, entering less information about the investor delivers a less-customized result

- Sometimes it’s worthwhile to enter more information in order to get a more informed output

3. CalcXML

Pros

- Explores attitudes towards risk with ten thought-provoking questions

- The best exploration of investor risk done by the calculators

- The model portfolio “Detailed Data Table” provided additional portfolio details that would be useful to review with your financial advisor

Cons

- The multiple-choice dropdown buttons are awkward to use

- Answering the ten questions took a long time

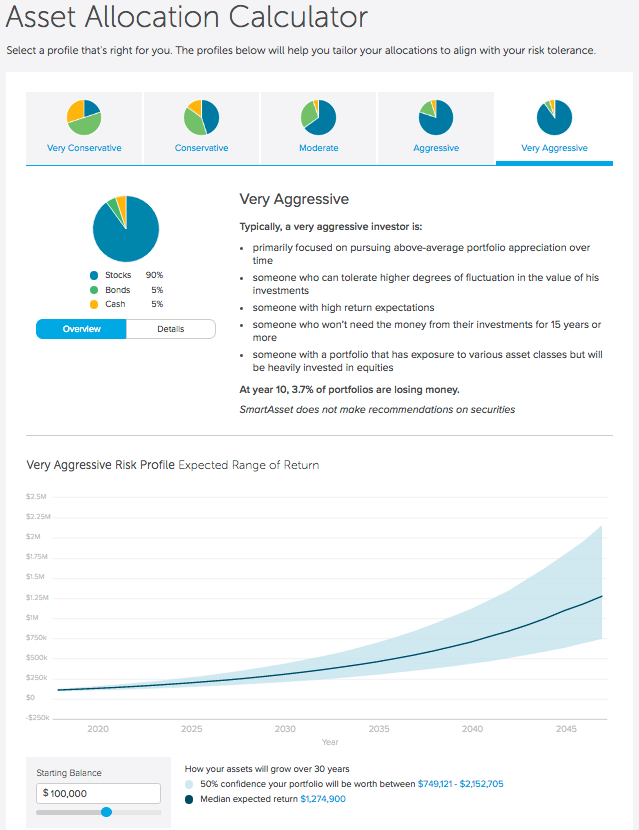

4. SmartAsset.com

Pros

- The calculator’s presentation is very effective

- It requires only a one-click input

- Nice graphical presentation of output and variability

- Excellent explanation of underlying assumptions

- Compelling underlying mathematical model

“Our asset allocation tool shows you suggested portfolio breakdowns based on the risk profile that you choose. We use historical returns and standard deviations of stocks, bonds and cash to simulate what your return may be over time. We use a Monte Carlo simulation model to calculate the expected returns of 10,000 portfolios for each risk profile. Then we use the results of that simulation to show you the range of values that your initial portfolio amount may grow into, as well as the likelihood of reaching that range.”

Cons

- It takes a while to understand the calculator output

- If you did well in statistics, you’ll definitely like the output presentation

- We’re not sure why they included a “Best Performing Stocks (2011 – 2016)” infographic at the bottom of the asset calculator page. As far as we could tell, this infographic has nothing to do with the asset calculator.

A Factor Not Considered by the Asset Allocation Calculators

Interestingly, none of the four asset allocation calculators considered whether or not we thought that current stock and bond markets were fairly valued, overvalued, or undervalued. Considering this data point would improve the calculator’s assessment of an investor’s appetite for risk.BankRate’s calculator came closest to considering such a factor by including the investor’s economic outlook in its model.“On a scale of 1 to 10, is your view of future economic growth and the overall health of the economy. The better your outlook, the more aggressive you can be with your investments.”We concluded that three of the four asset allocation calculators were very useful. We found that the CNN calculator delivered limited value.

Warning: The information and interactive calculators presented are learning tools for your personal use. None of the calculators described above have been checked for accuracy or applicability. These calculators and the articles on this website do not give investment advice. The calculations provided are not financial, legal or tax advice. Investors should seek professional advice from licensed financial, legal, and tax professionals. The circumstances described in this article are hypothetical and are used for illustrative purposes only. These calculators and illustrative examples may use historical performance information, however, past performance does not guarantee nor indicate future investment returns.

2.

2.